New APRA Rules Effective 1 February 2026

What Australian Expats Need to Know Before Buying Property at Home

From 1 February 2026, Australia’s banking regulator, the Australian Prudential Regulation Authority (APRA), has introduced a significant change to mortgage lending rules that may affect some borrowers — particularly investors and higher-income earners purchasing property in Australia.

If you’re an Australian living overseas and planning to buy or invest back home, understanding how these new rules work — and whether they apply to you — is essential.

✅ 1. Debt-to-Income (DTI) Limits Introduced

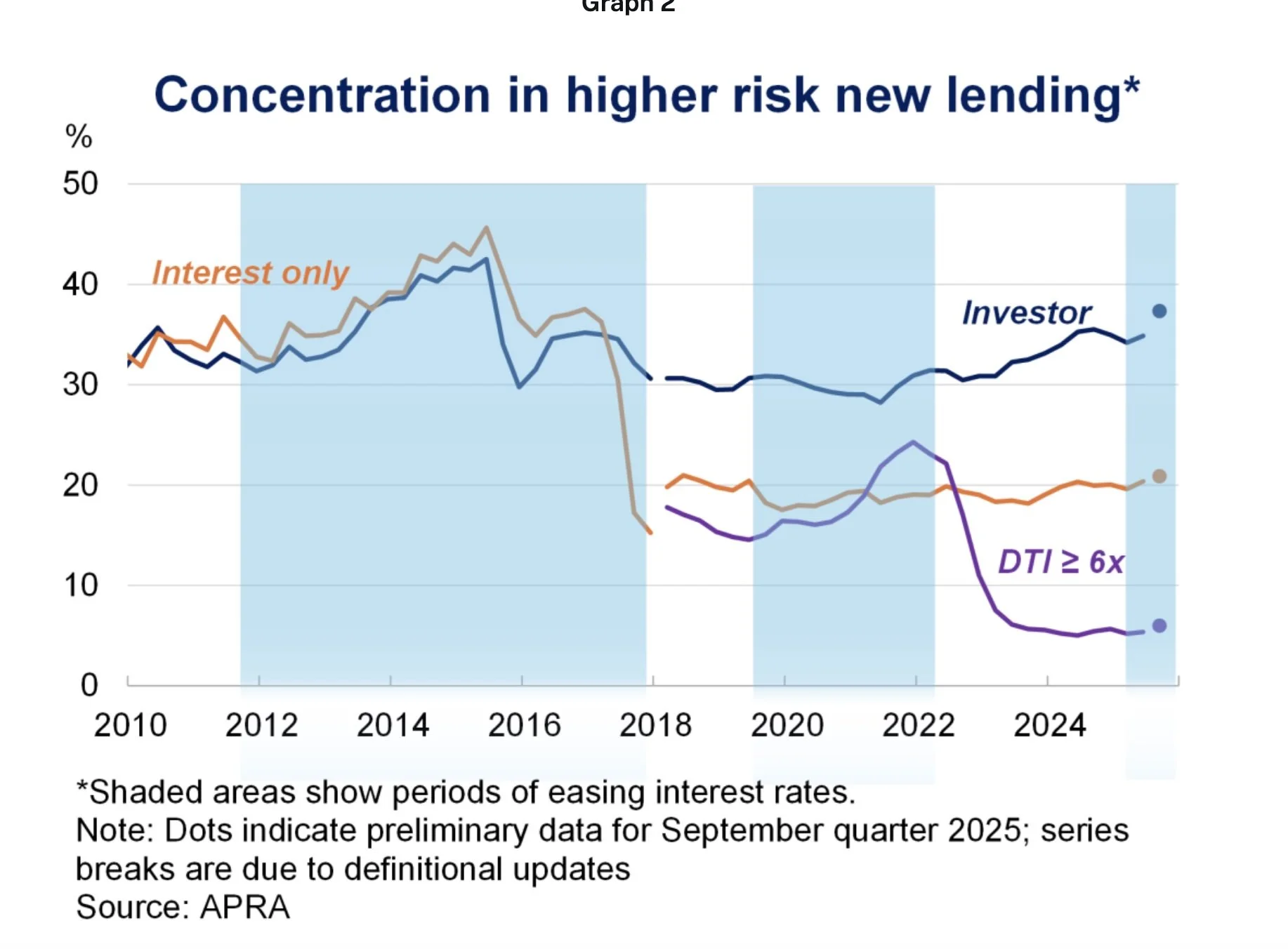

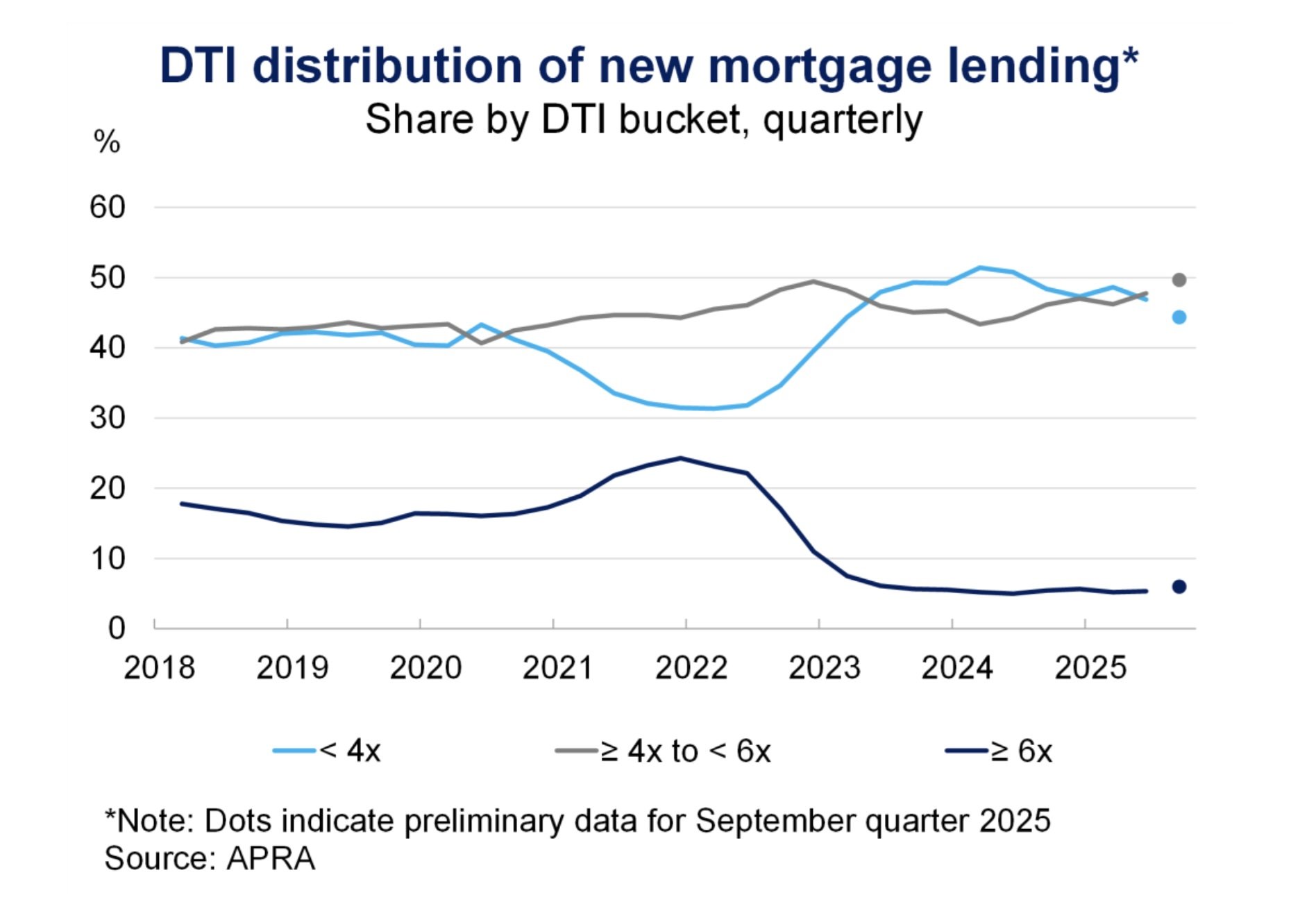

For the first time, APRA has activated a formal Debt-to-Income (DTI) cap as a macroprudential policy tool.

What’s changing?

From 1 February 2026:

Banks (Authorised Deposit-taking Institutions or ADIs) can issue no more than 20% of new mortgage loans where the borrower’s total debt exceeds

six times their gross annual income (DTI ≥ 6)This cap is applied separately to:

Owner-occupier loans

Investment loans

This means lenders manage two distinct “buckets” — one for owner-occupiers and one for investors.

Why six times income?

A DTI of 6× income is widely considered the point at which household debt becomes more vulnerable to:

Interest rate increases

Income disruptions

Broader economic shocks

APRA’s aim is to limit systemic risk — not to stop people from borrowing altogether.

📍 2. Who Will Be Affected?

Although the rules apply to all new loans from 1 February 2026, the impact won’t be the same for everyone.

✔ Most owner-occupiers may see little immediate change

Most standard home buyers already borrow well below a 6× DTI

Across the banking system, high-DTI loans currently make up a relatively small share of lending

For many expat owner-occupiers purchasing a family home, the change may be minimal.

⚠ Investors and highly geared borrowers are more likely to feel it

Borrowers who are more likely to be affected include:

Property investors

Expats with existing Australian debt

High-income earners using leverage to build portfolios

In these cases:

Borrowing capacity may be reduced

Some banks may become more selective if they approach their 20% high-DTI limit

Stronger income profiles may be prioritised

This makes lender selection and loan structure more important than ever.

🚫 Loans excluded from the DTI cap

The following loan types are not counted toward the DTI limit:

Bridging loans (when buying and selling)

Loans for newly built or under-construction properties

These exemptions are designed to avoid restricting housing supply or genuine home transitions.

📊 3. Why APRA Is Introducing These Changes

APRA has described the new DTI limits as a preventative safeguard, designed to protect both:

The financial system

Borrowers themselves

Key drivers behind the change:

Rising household debt levels

Sustained credit growth

Concerns that high-DTI lending could accelerate too quickly

The risk that high leverage amplifies stress if rates rise or incomes soften

Rather than tightening lending after problems emerge, APRA is acting early to contain risk.

📌 4. What Australian Expats Should Know Going Into 2026

🔍 A. Borrowing capacity may feel tighter for high-DTI applications

If your proposed loan would place you above six times income, lenders may:

Take a more conservative approach

Require stronger documentation

Delay approvals if internal DTI limits are close to being reached

This is especially relevant for expats with:

Foreign income

Multiple properties

Existing Australian liabilities

💡 B. Most buyers won’t see immediate disruption

These rules are intended as a guardrail, not a handbrake.

If your borrowing sits comfortably below the DTI threshold, you may not notice any practical change at all.

📈 C. Investors and refinancing expats need careful planning

If you’re:

Expanding a portfolio

Refinancing while overseas

Combining multiple income sources

Then strategy, structure and lender choice will play a much bigger role under the new rules.

This is where working with an expat-specialist broker matters.

🛠 D. Existing loans are not affected

The DTI cap:

Applies only to new loans written from 1 February 2026

Does not trigger automatic re-testing of existing mortgages

📝 Bottom Line

From 1 February 2026, APRA’s new debt-to-income limits introduce the first formal cap on high-leverage lending in Australia.

For most borrowers — including many Australian expats — the impact may be limited. However, investors and higher-geared buyers should plan early to understand how their borrowing capacity and lender options may shift under the new environment.

With the right structure and advice, buying property in Australia from overseas remains very achievable — even under tighter rules.

Ready to understand how these changes affect you?

To explore your options, you can book a complimentary discovery call with Founding Director and Principal Mortgage Broker Adam Kingston.

Adam will walk you through:

Your borrowing capacity as an Australian expat

How APRA’s new rules apply to your situation

The most appropriate lending strategy for your goals

All with the clarity, care and expertise Australian Expat Finance clients consistently praise.

The information contained is general information only and does not consider your objectives, financial situation and needs. Please talk to us if you need a fast-tracked home loan, and we can help you find a lender that has the processes in place to process the application quickly. We strongly recommend that you do not act on any information provided on this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

Australian Expatriate Finance always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.