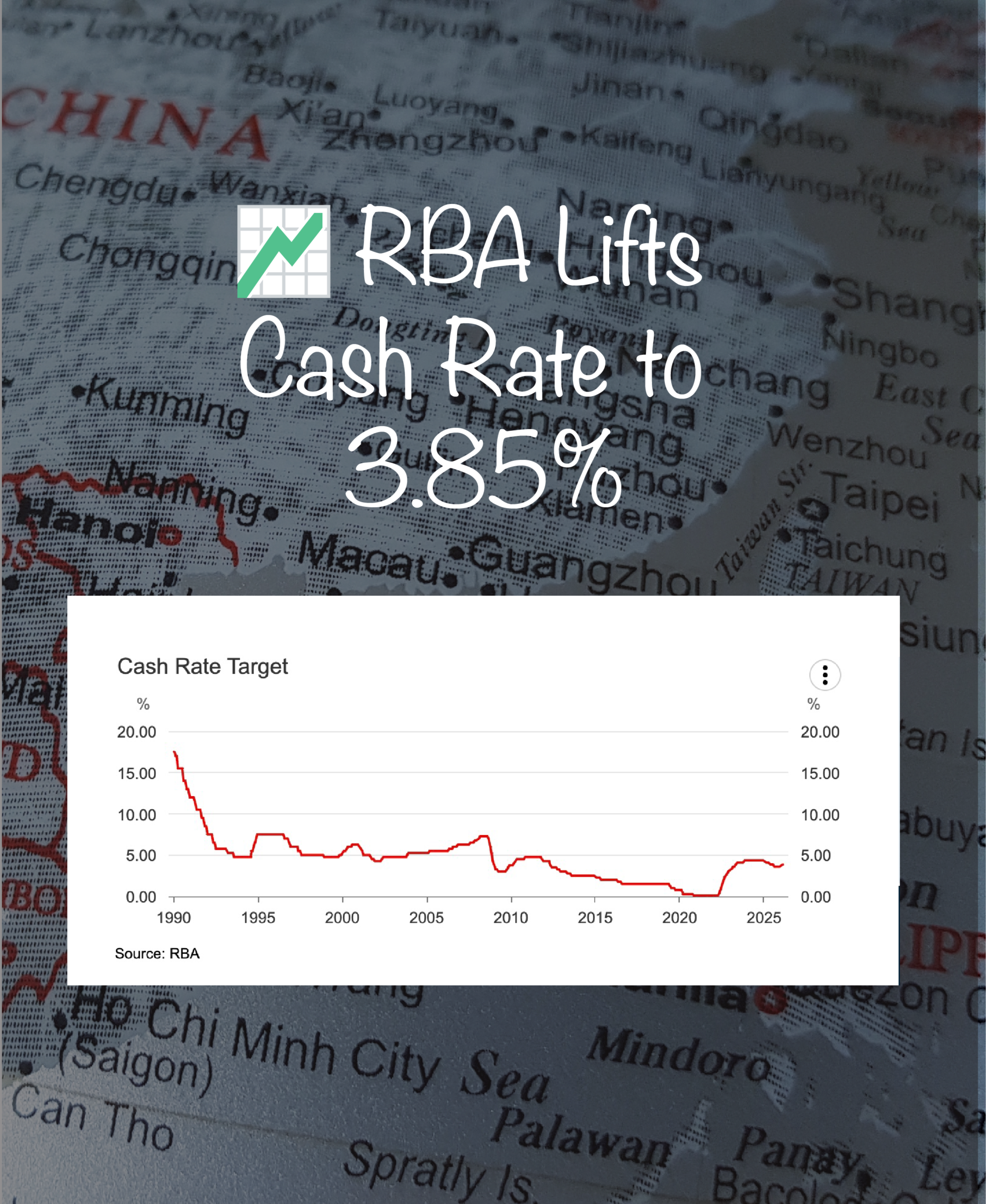

RBA Lifts Cash Rate to 3.85% – What This Means for Australian Expats

On 3 February 2026, the Reserve Bank of Australia (RBA) lifted the official cash rate by 25 basis points, taking it to 3.85%.

For Australian expats, this decision matters — not just for repayments, but for borrowing capacity, lender policy, and timing decisions, particularly when buying or refinancing property from overseas.

Why Did the RBA Raise Rates?

In simple terms, the RBA is concerned the Australian economy is running hotter than expected, and inflation may remain elevated for longer.

Key factors behind the decision include:

Household spending and private investment stronger than forecast

Ongoing uplift in housing prices and activity

Credit still flowing freely through the system

A tight labour market with low unemployment and solid wage growth

Increasing capacity pressures across the economy

When demand grows faster than supply, inflation becomes harder to control — and interest rates are the RBA’s primary tool to slow things down.

What Does This Mean for Interest Rates?

Variable-rate borrowers

Most variable-rate borrowers should expect lenders to pass on the increase, resulting in higher monthly repayments.

Fixed-rate borrowers

If you’re currently on a fixed rate, nothing changes immediately — but this decision reinforces that:

rate relief may be slower than previously expected

refinancing strategy matters well before your fixed rate expires

The RBA has made it clear that:

inflation is not yet fully under control

policy may remain restrictive for some time

future rate decisions will be data-dependent, not on a set path

What This Means If You’re an Expat Buying or Refinancing

For expats, interest rate movements are only part of the picture. Lender policy, currency exposure, and loan structure often matter more than headline rates.

What we’re seeing right now:

Lender selection is critical — policy differences can materially impact borrowing capacity for expats

Split loan strategies are increasingly effective (part fixed, part variable)

Offset access, cash buffers, and flexibility matter more than chasing the lowest rate

Longer-term planning is outperforming short-term rate chasing

Well-structured loans are helping expats remain competitive — even in a higher-rate environment.

Our Take

This rate rise is a clear signal that the RBA remains focused on inflation control, even if that means keeping pressure on borrowers for longer.

The positive news?

Employment remains strong

Incomes are rising

Housing demand is holding firm

For expats, opportunity still exists — provided lending is structured correctly, and decisions are made with a medium- to long-term strategy in mind.

If you’d like to understand how this decision affects your borrowing capacity, repayments, or purchase plans from offshore, a discovery call can help clarify your options.

Ready to Talk?

If any of this sounds like you, it’s probably time for a conversation.

📩 To discuss your plans and see how this applies to your situation, book a complimentary discovery call with Adam Kingston, Director of Australian Expat Finance and Expat Home Loan Specialist.

The information contained is general information only and does not consider your objectives, financial situation and needs. Please talk to us if you need a fast-tracked home loan, and we can help you find a lender that has the processes in place to process the application quickly. We strongly recommend that you do not act on any information provided on this website without individual advice from your trusted advisor. You should also obtain a copy of and consider the Product Disclosure Statement for all financial products before making any decision.

Australian Expatriate Finance always tries to make sure all information is accurate. However, when reading our website, please always consider our Disclaimer policy.